The Top 5 Jurisdictions iGaming Operators Should Monitor in 2026

- Author:Palak Madan

- Read Time:

- Published:

- Last Update:February 19th, 2026

Discover the top 5 iGaming markets to watch in 2026. Learn about their rules, growth potential, and why they matter for operators planning to expand.

The biggest winners in the iGaming industry made their money by spotting opportunities everyone else missed.

Right now, five places around the world have opened their doors to online betting in ways that could give you substantial returns.

While most iGaming software provider companies crowd into the same old markets, the real winners are quietly moving to these new hot spots.

Here are the five iGaming jurisdictions where operators can set up their shop in 2025.

Let’s get the ball rolling.

Why Monitoring Global iGaming Jurisdictions Matters More Than Ever?

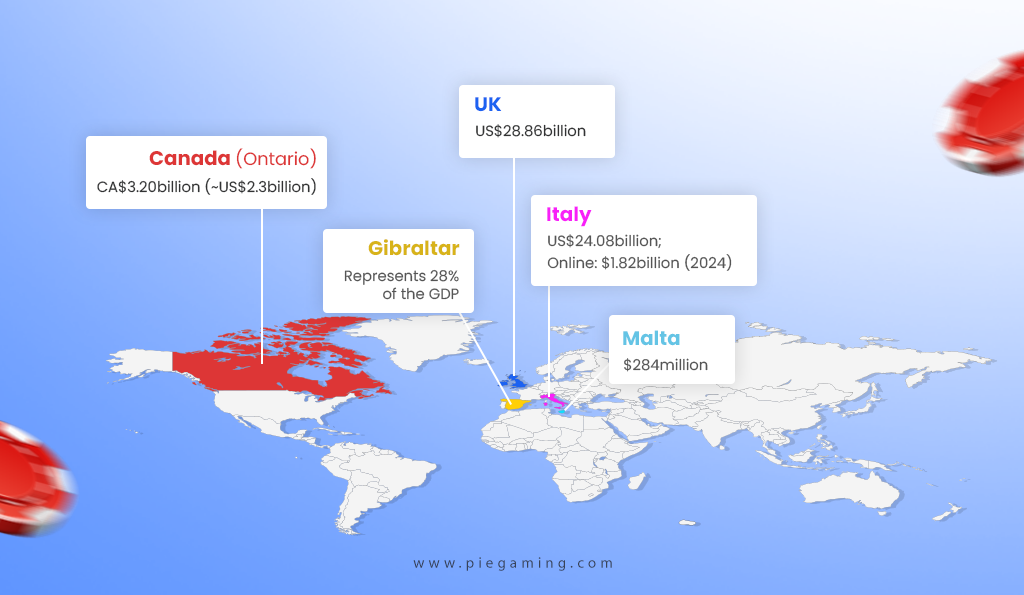

Market Sizes of the top five iGaming jurisdictions

Companies everywhere are making new rules to keep betting safe, fair, and properly taxed due to the changing nature of the iGaming industry.

This makes things tricky for betting companies who need to follow different rules in each country.

iGaming jurisdictions are adapting quickly with new regulations, making compliance more complex.

These days, iGaming companies must deal with tougher checks on who their players are, more rules about money handling, and more steps to protect players.

Places like Germany, the Netherlands, and Brazil have made very strict rules that companies must follow.

The dangers are real- companies that break the rules might have to pay big fines, lose their right to operate, or be kept out of regulated iGaming markets.

At the same time, emerging iGaming markets like Brazil, Thailand offer good chances to grow. But here’s the catch- only companies that actually learn and follow the local rules will succeed.

Making things even harder, rule-makers now use new computer tools to watch betting activities and catch companies that don’t follow the rules.

For iGaming operators, keeping up with the changing rules is crucial.

First, it helps them gain trust from players.

Second, it protects their goodwill in the industry.

Finally, it ensures they can stay in business for years to come in this competitive market.

In short, knowing the pulse of iGaming jurisdictions gives operators an edge in planning expansion and staying compliant.

The 5 iGaming Jurisdictions to Watch Closely in 2026

Pay close attention to these five iGaming jurisdictions; what happens here will matter to everyone in the business.

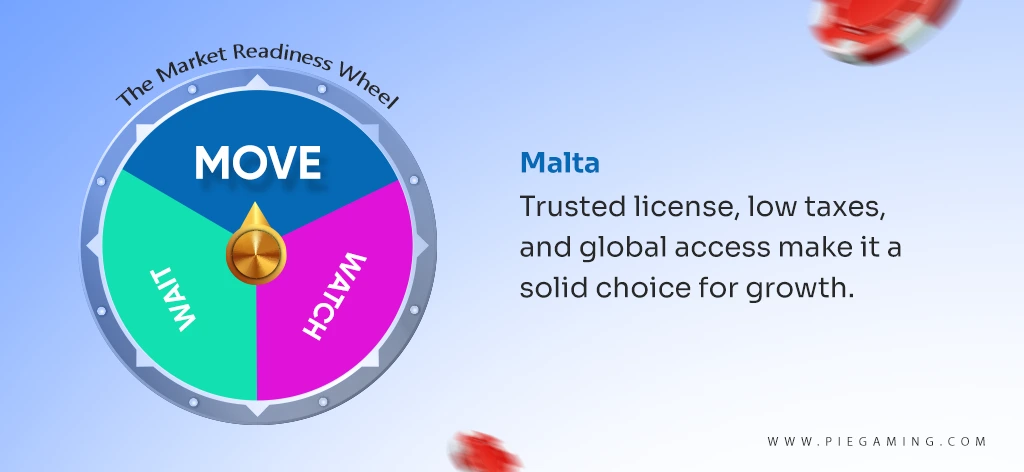

1) Malta

Overview of Malta’s iGaming Market

Malta is the top iGaming hub, overseen by the Malta Gaming Authority (MGA).

The MGA watches over all types of iGaming activities like Casinos, sports betting, poker, and lotteries.

They offer two main types of permits: one for companies that run betting sites (B2C) and another for companies that make iGaming software (B2B).

The process to get a permit includes thorough background checks, technical testing, and ongoing oversight to ensure players are protected.

In iGaming jurisdictions, Malta is changing how it oversees betting companies.

The MGA is used now using more data and taking a more active approach to supervision.

Benefits For Operators

Here’s what it means for operators:

- A well-respected Malta iGaming license that opens doors worldwide.

- Access to European and global markets.

- A growing betting community with over 300 licensed operators.

- Tax rates can be as low as 5%.

The simple licensing process, strong player trust, and support for new technology make Malta very attractive for both new and established companies.

Risks and Challenges

Here are some challenges and risks to look out for:

- Getting and keeping a Malta license takes work and money.

The application process can take up to six months and requires investment and setting up a local office.

- Companies face more oversight in iGaming jurisdictions, especially around money laundering prevention and financial transparency.

Changes in European Union rules could affect operations across borders.

2) United Kingdom

Overview of the UK’s iGaming regulations

The UK has one of the world’s most developed and strictly controlled iGaming jurisdictions.

The UK Gambling Commission (UKGC) oversees all forms of iGaming, including casinos, sports betting, bingo, and lotteries.

Companies must get a UKGC license to legally offer betting services to UK residents.

The rules are based on the Gambling Act 2005, with regular updates to address new risks and technologies.

2025 brings new changes to UK betting rules:

- New Betting Limits: £5 maximum per spin for adults, £2 for players ages 18-24.

- A required betting levy to fund research and treatment.

- Stricter checks on players’ identities and spending ability.

- Ban on features like Autoplay and Turbo Spins.

Marketing rules are also tighter, requiring players to choose whether they want to receive communications and making safety messages more visible.

Benefits For Operators

- The UK remains one of the biggest and most profitable iGaming jurisdictions in the world. It’s worth $8.7 billion in 2024 and still growing.

- A UK iGaming license is well respected worldwide and can help companies enter other compliant jurisdictions for operators.

- Companies that invest in following the rules and protecting players can stand out from competitors and build player loyalty.

Risks and Challenges:

- The UK’s rules are increasingly complex and demanding. Companies face high costs to follow these rules, frequent checks, and the risk of big fines for breaking them.

- The new betting levy and affordability checks add financial burden and operational burdens.

- Stricter advertising rules and bans on certain game features may affect marketing strategies and income.

- Political attention and ongoing gambling law updates mean requirements can change quickly, making flexibility and staying ahead of compliance essential for success.

3) Italy

Overview of Italy’s iGaming Market

Italy has one of Europe’s biggest iGaming jurisdictions.

The Customs and Monopolies Agency watches over it. Companies pay €7 million for a license (split into two payments) plus 3% of what they earn each year after taxes.

To qualify companies, they need experience in Europe and an office in the European area. Companies must also add safety features, like spending limits for players.

2025 is a big year for betting in Italy. The biggest changes in ten years are now in full swing.

- The government gave companies extra time to adjust to new rules.

- Taxes went up a little bit- casino taxes rose from 25% to 25.5% and sports betting taxes went from 24% to 24.5%.

- The government has a two-year plan to make betting safer and stop illegal operators.

- They might also rethink the strict ban on ads that started in 2019.

Benefits For Operators

Italy is still a profitable market for betting businesses. The market should grow to over $66 billion by 2033.

- The nine-year licenses give companies stability, and the clear rules aim to bring in big international brands.

- The changes should bring more tax money to Italy and keep it as a top betting spot in Europe.

- Companies that follow the new rules will find plenty of bettors in a country where betting is widely accepted.

Risks and Challenges

The €7 million license fee and 3% yearly tax are hard to afford, especially for smaller companies. This might mean smaller companies can compete.

The strict rules and technical demands add more work.

The ad ban makes it hard for companies to get noticed.

Companies also face more frequent checks on responsible betting and money laundering.

Plus, there’s ongoing uncertainty as the government keeps tweaking its plans for iGaming jurisdictions.

4) Gibraltar

Overview of Gibraltar’s iGaming Market

Gibraltar is a small but mighty player in the iGaming jurisdictions list.

Under their Gambling Act 2005, the Gambling Commissioner keeps an eye on everything.

If you want to run an online casino, sports betting site, or poker room here, you will need a license.

Gibraltar is picky about who gets in; they mostly like established companies with good track records, though they’ll consider promising newcomers too.

To get approved, companies need to set up real offices in Gibraltar and follow strict rules about keeping betting safe and fair.

2025 is huge for the Gibraltar betting scene.

They are rolling out a brand-new Gambling Act that shakes things up.

Companies now need a bigger presence in Gibraltar- actual offices, local staff, and they must help the local economy.

The new rules cover more types of betting than before and give the gambling commissioner more power to surprise everyone.

All these changes aim to keep Gibraltar’s reputation strong among iGaming jurisdictions in 2025 in a post-Brexit world.

Benefits For Operators

Gibraltar remains a fantastic home base for betting businesses.

The taxes are super low- just 0.15 on yearly earnings, down from 1% before. That’s a big saving.

The territory has lots of skilled workers, excellent internet infrastructure, and is already home to major iGaming brands.

Having a Gibraltar license helps companies access the UK market and shows they’re trustworthy.

The government is friendly to business and innovation, and the new rules should create a stable environment for years to come.

Risks and Challenges

It’s not all smooth sailing.

- Licensing fees are now higher- £100,000 for companies that serve players directly and £85,000 for iGaming software providers.

- Companies must have local operations, which means spending more on offices and staff.

- The application process is tough and detailed.

- Brexit continues to cause headaches, especially when trying to serve European bettors.

- The rules keep changing, so companies must stay on their toes to follow them.

- Breaking the rules can mean big fines or losing your license entirely.

5) Canada (Ontario)

Overview of Canada’s iGaming Market

Ontario runs Canada’s biggest legal online betting market and stands out among iGaming jurisdictions in 2025.

Two main groups watch over everything:

- The Alcohol and Gambling Commission of Ontario (AGCO)

- iGaming Ontario (iGO)

If you want to offer online casinos, sports betting, or lottery games here, you need to sign up with AGCO and make a deal with IGO.

The rules are tough- companies must check players’ identities, fight money laundering, and help people bet responsibly.

Instead of giving out traditional licenses, iGO partners with companies and ensures they play by the rules to keep betting fair and players safe.

In 2025, you can expect changes in Ontario’s betting market.

A new law called the iGaming Ontario Act is expected to kick in early this year.

It gives the IGO more freedom to make its own decisions, separate from ACGO.

The law brings new rules about who can operate, better ways to protect players, and changes to how money flows.

Ontario’s approach is setting an example for other Canadian provinces, making it a trendsetter in North American iGaming jurisdictions in 2025.

Benefits For Operators:

Ontario is Canada’s most populated province with the country’s largest iGaming jurisdiction in the 2025 market.

As of early 2025, 49 licensed operators run 84 betting platforms here.

The numbers are impressive: CA $82.7 billion in bets and CA $3.2 billion in revenue last year, growing by 32%.

Casino games make the most money, followed by sports betting and Poker.

Companies love clear rules, a trusted environment, and the fact that players don’t pay taxes on their winnings (unless betting is their job).

This market attracts both big-name brands and newcomers looking for reliable online casino licensing.

Risks and Challenges

Ontario has some of North America’s strictest betting rules.

Companies face layers of requirements from federal, provincial, and iGO standards.

Getting approved is no walk in the park- it takes lots of paperwork and regular check-ups.

Advertising rules are tight, too. Companies can’t promote bonuses or free stuff, and new rules limit athletes and influencers in ads.

With the new iGO Act coming, there’s uncertainty about future requirements, taxes, and costs.

Wrapping Up…

Keeping an eye on these five hot iGaming jurisdictions in 2025 is a smart move for any operator looking to grow.

Each region offers chances to reach new players and boost profits.

Focus on these hot markets, jump in at the right time, and you could hit the jackpot while others are still at the starting line.

FAQs

-

Which factors make a jurisdiction attractive for iGaming operators in 2025?

The best places have clear rules, trusted licensing authorities, fair taxes, easy application steps and access to big or growing player markets.

-

How can operators ensure compliance in new jurisdictions?

iGaming businesses can stay compliant by learning local regulations thoroughly. Additionally, by using good identity verification systems and staying in touch with regulators to keep up with changes.

-

What challenges do iGaming operators face in these jurisdictions?

Companies struggle with expensive licenses, complicated rules to follow, strict limits on advertising, constantly changing regulations, and the risk that laws might suddenly change.

-

What is the difference between a white label license and a full license in iGaming jurisdictions?

With a white label license, you operate under another company’s permit, and they handle many legal requirements. With a full license, you are directly responsible for following all regulations but have complete control over your betting operation.

Palak Madan is a enthusiastic writer at PieGaming. With over 2+years of experience crafting engaging content and a strong literature background, Palak brings a unique perspective to the world of words. Her ability to blend creativity with strategic thinking has made her a sought-after content creator. She's eager to dive deep into the intricacies of iGaming software, uncovering the stories behind the technology and translating complex features into compelling narratives.

-

Monika Gola November 17, 2025

Monika Gola November 17, 2025To obtain the Anjouan Gaming License, applicants must collect and submit all the important documents. Learn the process of obtaining Anjouan iGaming license.

-

Monika Gola September 23, 2025

Monika Gola September 23, 2025This blog covers everything from success keys to case studies of successful Asian iGaming operators to help start your dream business. Whether…

-

Palak Madan September 11, 2025

Palak Madan September 11, 2025Self-exclusion tools are changing how online casinos work. They help players control their gambling while protecting casino operators from legal problems, bad publicity,…

-

Palak Madan August 28, 2025

Palak Madan August 28, 2025Learn how to get a Kahnawake iGaming license in 2026 with this step-by-step guide covering eligibility, application requirements, costs, and compliance for online…

-

Monika Gola August 28, 2025

Monika Gola August 28, 2025Compare Malta vs Curacao iGaming license. Explore cost, application process, taxation, compliance to choose the right license for your business.

-

Monika Gola August 20, 2025

Monika Gola August 20, 2025This blog explores ways and platforms to find and partner with top sports betting affiliates to grow the iGaming business. When Nicole launched…

-

Palak Madan August 13, 2025

Palak Madan August 13, 2025Learn how iGaming affiliate marketing software helps operators boost revenue with real-time data, automation, fraud control, and flexible payouts.

-

Palak Madan July 24, 2025

Palak Madan July 24, 2025Learn the step-by-step process to apply for an Isle of Man iGaming license, including requirements, costs, timelines, and key benefits for operators.

-

Monika Gola July 17, 2025

Monika Gola July 17, 2025Want to grow like the top iGaming operators in 2025? Learn the strategies behind industry leaders like DraftKings, Bet365, etc., to grow your platform.

-

Monika Gola July 14, 2025

Monika Gola July 14, 2025This blog is a comprehensive guide on key success strategies for European iGaming Operators. Read on to build your iGaming empire in the…

-

Monika Gola June 27, 2025

Monika Gola June 27, 2025If you have landed on this blog, that simply means you’re planning to enter among the most lucrative iGaming markets in the world…

-

Monika Gola June 24, 2025

Monika Gola June 24, 2025In this blog, we will focus on the South Africa iGaming license, step-by-step process to obtain it, and much more. Read here to…

-

Monika Gola June 18, 2025

Monika Gola June 18, 2025Malta iGaming License is one of the most popular licenses among operators. But, obtaining it can be a challenge. This guide walks you…

-

Monika Gola June 9, 2025

Monika Gola June 9, 2025The Curaçao iGaming License has been among the most preferred choices for online casino and sports betting operators. Take a closer look at…

-

Monika Gola January 28, 2025

Monika Gola January 28, 2025Explore the best iGaming affiliate software providers. Compare platforms with features, pros & cons, and tracking models.

-

Palak Madan January 17, 2025

Palak Madan January 17, 2025Provably Fair technology makes online gaming more trustworthy by letting players check game results for fairness, ensuring transparency, and building confidence in gaming…

-

Monika Gola November 27, 2024

Monika Gola November 27, 2024This read talks about the leading iGaming Payment Solutions Providers to enhance players’ experience and ease out the transaction process globally. Excitement into…

-

Simranjeet Kaur August 14, 2024

Simranjeet Kaur August 14, 2024White-label iGaming software provides a foundation for online betting platforms. But its true value lies in customization. These solutions offer a ready-made framework….

-

Simranjeet Kaur August 13, 2024

Simranjeet Kaur August 13, 2024The iGaming industry has grown a lot in the past decade. Now, it’s not just about tech experts or big casinos. With iGaming…

-

Nikita Ajmani August 7, 2024

Nikita Ajmani August 7, 2024iGaming has become one of the most profitable industry in the world today. With a growing interest in gambling and more disposable income,…

-

Nikita Ajmani July 24, 2024

Nikita Ajmani July 24, 2024This blog will explore the main factors to think about when choosing an iGaming software developer. It will also cover other important questions…

-

Simranjeet Kaur June 20, 2024

Simranjeet Kaur June 20, 2024Software providers in the iGaming industry play a very crucial role. We’ve prepared a guide on selecting the right one for your business. …

-

Simranjeet Kaur June 18, 2024

Simranjeet Kaur June 18, 2024Imagine a world-famous casino, having millions of people visit it daily. Everything seems to be running smoothly until one day when a cyber…

-

Palak Madan June 7, 2024

Palak Madan June 7, 2024White label iGaming Solutions offer ready-made, budget-friendly gambling websites. They come with AI tools, automation, and built-in legal compliance. They help you customize…

-

PieGaming Staff February 13, 2024

PieGaming Staff February 13, 202411 Step-by-Step guide and market insights to start a solid Online Poker Game Business today and Create a strong player base for your new business.

-

PieGaming Staff January 19, 2024

PieGaming Staff January 19, 2024The Software Development Life Cycle (SDLC) process is followed to develop and maintain software. In SDLC, how an iGaming software will function is determined.

-

Palak Madan January 18, 2024

Palak Madan January 18, 2024Steps to find the right turnkey iGaming software provider for your iGaming business. One who can help your business achieve a thriving business within weeks.

-

PieGaming Staff December 22, 2023

PieGaming Staff December 22, 2023Discover how the custom front end improves the user experience to aid player acquisition & retention. Read do’s & don’t’s of great visual front-end.

-

Piegaming Admin December 20, 2023

Piegaming Admin December 20, 2023Discover how digital wallet payments in iGaming help ensure speedy, safe, and accurate transactions. Know which types of digital wallets are worth adding.

-

Monika Gola December 19, 2023

Monika Gola December 19, 2023To get an online gaming license, you need to establish a legal entity where you want to operate, followed by legal procedures. Read here.

-

PieGaming Staff December 13, 2023

PieGaming Staff December 13, 2023Latin America is a brewing market for iGaming Industry. In this blog discover some lucrative trends, challenges and future opportunities Latin America holds.

-

Monika Gola December 12, 2023

Monika Gola December 12, 2023Artificial Intelligence has truly transformed the gaming industry by enhancing gamеplay еxpеriеncеs, personalisation and predictive designing. Read for more.

-

PieGaming Staff December 10, 2023

PieGaming Staff December 10, 2023If you understand the pulse of the iGaming industry, you already know how important it is to run affiliate marketing programs for your…

-

Palak Madan November 1, 2023

Palak Madan November 1, 2023RNG in iGaming is a software that creates random results in online casino games. It produces a new, unpredictable outcome each time a…

-

Palak Madan October 30, 2023

Palak Madan October 30, 2023This guide covers everything you need to know about what is iGaming, including online sports betting and casino market insights, history, popular games,…

Voila!

See you in your inbox soon!

Stay ahead of the game. Subscribe for exclusive content, updates, and insiders!

We use cookies to enhance and personalize your browsing experience. By continuing to use our website, you agree to our Privacy Policy.